“Step into the future of finance with Central Bank Digital Currency (CBDC) – a groundbreaking leap into a digital realm.”

Ever wonder our money can be turned into a smarter way?

In the rapidly evolving landscape of global finance, a digital revolution is quietly reshaping the very foundations of monetary systems, which is Central Bank Digital Currency (CBDC). CBDC is a virtual currency issued by a country’s central bank, serving as legal tender with the same value as fiat currency. It signifies a transformative shift in the financial landscape, with potential benefits like improved financial inclusion, lower transaction costs, and heightened efficiency in payment systems.

Watch the video below to get a comprehensive idea of CBDC: https://youtu.be/bAIS6-AjYOE?si=QN4Bzwbem2JVociQ

In Malaysia, our central bank issued a five-year plan to modernise the country’s financial sector, with a strong emphasis on digitalisation. Bank Negara Malaysia (BNM) outlined two major goals, which are strengthening digital infrastructure and ensuring ethical use of data.

Why BNM is looking into CBDCs?

BNM is researching CBDC to enhance its technical and policy capabilities, as cryptocurrencies do not have the universal characteristics of money and cannot be used as legal tender[i].

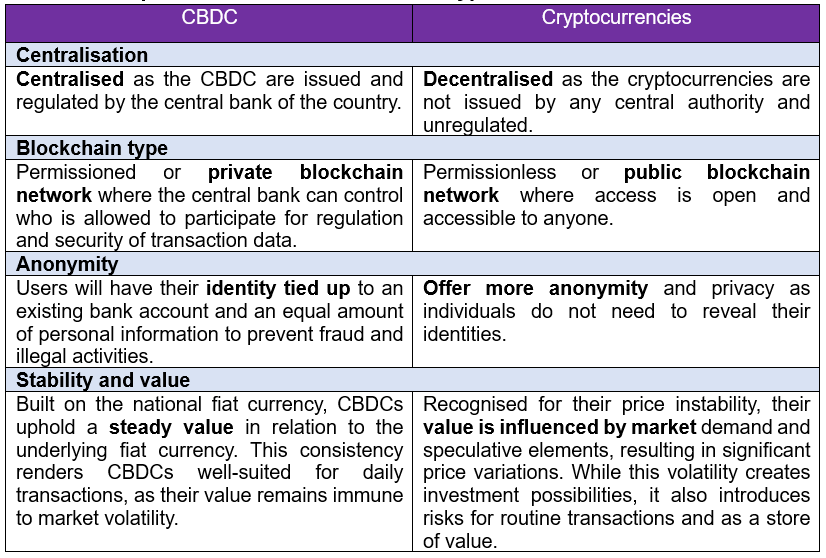

While CBDC is a virtual currency issued by central bank, however, it is different from the cryptocurrencies as outlined in the table below.

Table 1: Comparison Between CBDC and Cryptocurrencies

The advent of CBDCs traces back to 1993 when the Bank of Finland introduced the Avant smart card, a precursor to today’s digital currencies[i]. Although the system dropped in the early 2000s due to low demand and high costs, the idea gained traction as many central banks responded to the development and adoption of digital payments and cryptocurrencies[iii].

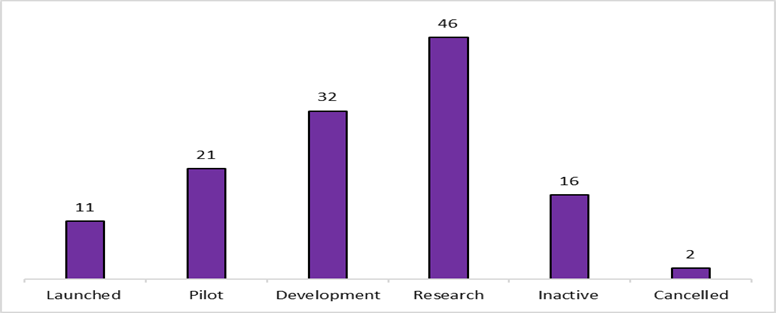

According to a report by the Bank for International Settlements (BIS), there are over 100 countries actively engaging in CBDC research as of June 2023[iv], with 11 countries having successfully launched CBDCs including The Bahamas, Jamaica, Anguilla, Antigua and Barbuda, Saint Kitts and Nevis, Montserrat, Dominica, Saint Lucia, Saint Vincent and the Grenadines, Grenada and Nigeria. Another 21 implementing pilot programs while 46 countries still in the research phase, as shown in Figure 1[v].

Figure 1: Number of countries exploring CBDC in June 2023

CBDCs have become a focal point of interest for numerous nations, prompting active exploration and varying degrees of implementation. Notably, China stands out as a pioneer in this field, leading the development of its digital yuan or e-CNY which has been tested in various cities and scenarios. The People’s Bank of China (PBOC) has undertaken extensive testing of its Digital Currency Electronic Payment (DCEP) across cities such as Shenzhen, Suzhou, Chengdu, and Beijing. The DCEP aims to augment transaction efficiency on both domestic and international fronts, reduce its dependence on the US dollar[vi], showcasing China’s commitment to digital currency advancements.

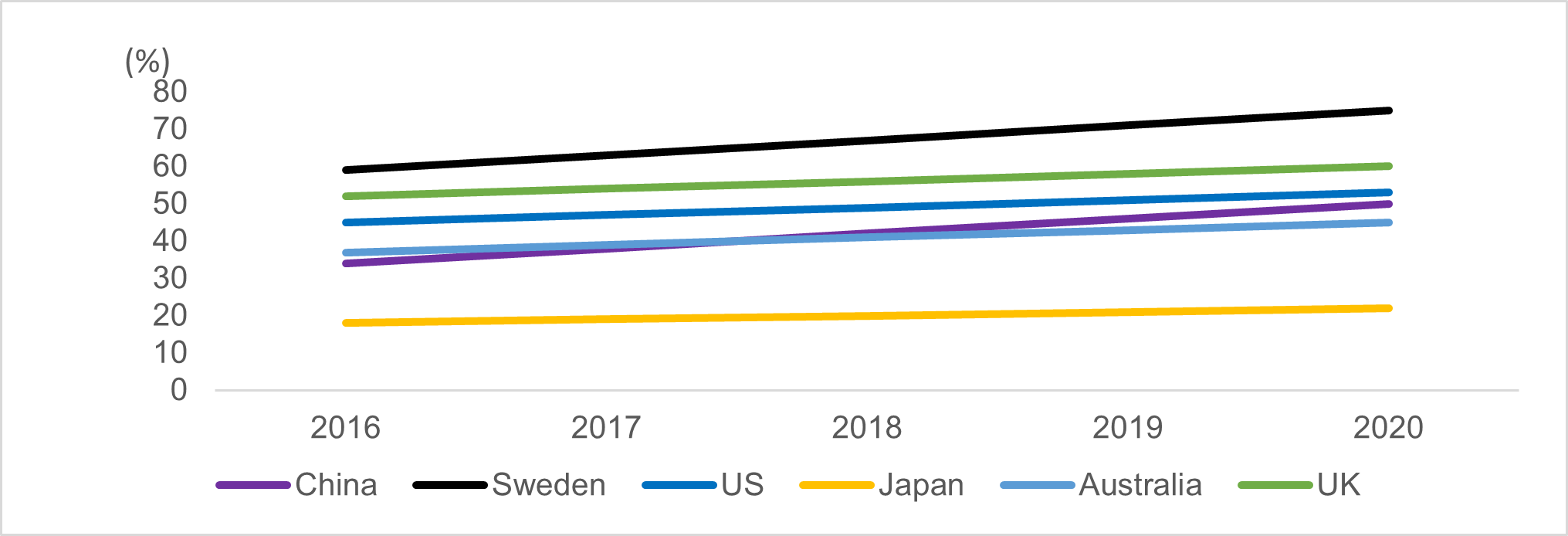

Figure 2: Usage of cashless payment from year 2016 to year 2020

Figure 2 indicates a significant increase of cashless payment usage from 2016 to 2020 in China, Sweden, the United States, Japan, Australia, and the United Kingdom. Motivated by reduced physical currency use, Sweden is exploring the e-krona to enhance payment infrastructure resilience. While the United States persist about the discussions on introducing a digital dollar, with the Federal Reserve actively researching CBDC benefits and risks through initiatives like the Digital Dollar Project, prompted by President Biden’s March 2022 executive order.

Singapore is also exploring CBDC issuance for wholesale and retail purposes. The Monetary Authority of Singapore (MAS) launched projects, including Project Ubin, demonstrating the benefits of blockchain technology for faster and cheaper cross-border transactions. Project Ubin, initiated in 2016 and completed in July 2020, showcased the viability of a blockchain-based multi-currency payments network.

While the global is exploring the digital currency, what has happened in Malaysia?

As of now, BNM has not made a final decision on CBDC issuance, stating that the current payment system in Malaysia is fast, efficient, and inclusive, with no immediate need for a CBDC.

To explore CBDC implementation in line with the Financial Sector Blueprint 2022-2026, BNM is following a phased approach:

a. Phase One: Cross-border Wholesale CBDC (Project Dunbar)

This project conducted in collaboration with the Reserve Bank of Australia, Monetary Authority of Singapore, South African Reserve Bank, and BIS Innovation Hub, aims to assess the application of wholesale CBDC for international settlements. The primary goal is to alleviate existing challenges in cross-border payments, such as speed, cost, transparency, and accessibility, through a shared platform. As Malaysia boasts an open economy with a trade-to-GDP ratio exceeding 130% since 2010, the potential for substantial cost savings and productivity gains is considerable.

A comprehensive report detailing the findings of Project Dunbar has been released in March 2022 revealing the development of two prototypes for a shared platform facilitating international settlements using digital currencies demonstrating the technical viability of direct cross-border transactions, thereby reducing reliance on intermediaries.

b. Phase Two: Domestic Wholesale CBDC

Innovative solutions utilising CBDC and Distributed Ledger Technology (DLT) (distributed digital system that securely records and verifies transactions) will be investigated to enhance and future-proof the Real-time Electronic Transfer of Funds and Securities System (RENTAS). By leveraging wholesale CBDC and DLT, there is an opportunity to mitigate the risk associated with a “single point of failure”, improve liquidity management, simplify compliance processes, and introduce new use cases such as the settlement of tokenised assets.

c. Phase Three: Domestic Retail CBDC

BNM aims to explore the role of CBDC in fostering innovation and bolstering diversity and resilience in retail payments. This phase will assess the potential of domestic retail CBDC to complement existing systems like the Real-time Retail Payments Platform (RPP), enhancing payment diversity and resilience while catalysing innovation in the financial sector. The programmable features of CBDC will be explored, enabling functionalities like streamlined compliance processes and automatic payments to beneficiaries under predefined conditions.

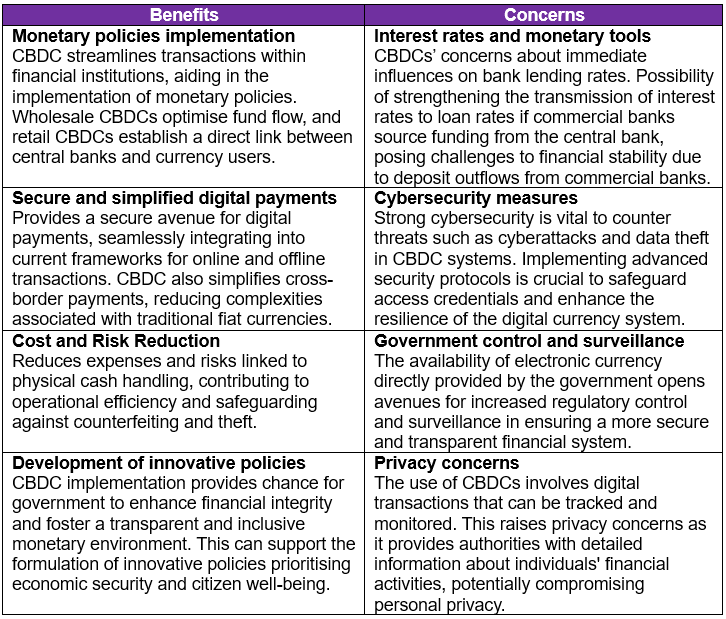

BNM has affirmed its commitment to ongoing vigilance over CBDC developments, aiming to assess the implications and ascertain the readiness for CBDC implementation in the Malaysian context[vii]. However, the policymakers should carefully investigate the benefits and concerns of CBDC as outlined in Table 2.

Table 2: Benefits and Concerns of CBDC

Up to this point, why is CBDC good for Malaysia?

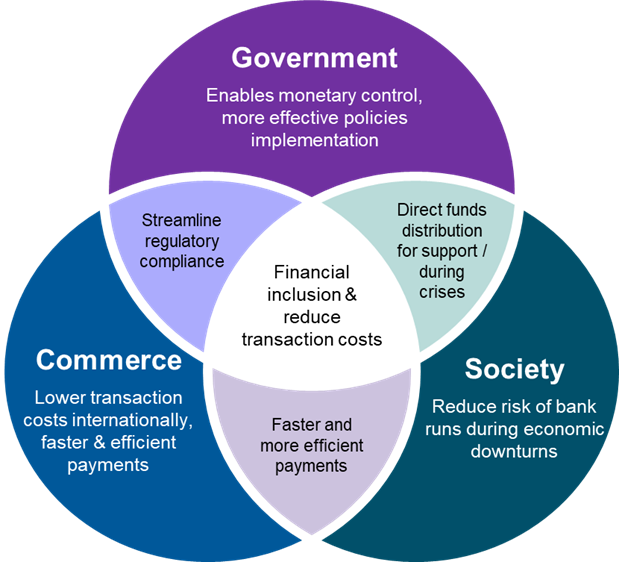

CBDC has the potential to bring benefits to the government, commerce, and society, as shown in the diagram below.

Now what will happen if Malaysians reject to adopt CBDC?

If our country chooses not to adopt CBDC, we may continue to grapple with challenges related to traditional cross-border transactions, facing delays and increased costs. Businesses may find their operations constrained by limited access to financial services during traditional banking hours. Moreover, the absence of CBDC could perpetuate financial exclusion, particularly in remote areas where traditional banking services are scarce, hindering economic participation and growth. Additionally, Malaysia may forego the advantages of leveraging blockchain technology to enhance transparency and reduce illicit financial activities.

The implementation of CBDC in Malaysia holds great potential for positive outcomes, drawing inspiration from the successes observed in countries like China.

Before ending, let’s have a look on how CBDCs work in the economy.

This paper is only the beginning of an exciting journey to a digital economy – and STRAT369 Consulting is ready to dig further on it.

STRAT369 Consulting Sdn Bhd is a Consulting company in the field of Strategy and Economics. Established in 2016 and registered with the Ministry of Finance (MOF), we are ready to navigate the dynamic landscape of Central Bank Digital Currency (CBDC) initiatives. With a proven track record, we possess expertise in conducting comprehensive studies across three key areas: Strategy & Economy, Public-Private Partnership, and Capital Projects & Infrastructure. Our commitment to staying abreast of industry developments and leveraging our strategic insights uniquely positions us to provide valuable consultation and support in the evolving realm of CBDC.

Footnote:

[i] Malaysia’s Digital Currency: Central Bank Studies Need for Electronic Money – Bloomberg

[ii] The Ascent of CBDCs

[iii] Central bank digital currencies: motives, economic implications and the research frontier

[iv] Making headway – Results of the 2022 BIS survey on central bank digital currencies and crypto

[v] Central Bank Digital Currency Tracker – Atlantic Council

[vi] China Is Doubling Down on its Digital Currency

[vii]Evaluating Malaysia’s Need for Central Bank Digital Currency